Passive Real Estate Investing Advice from Experienced LP Investors

Insights from Guests of the Invest Clearly Podcast

Investing as a limited partner (LP) in private real estate deals can be highly rewarding, but it’s high risk. Investors need to make smart decisions. Over the course of several episodes of The Invest Clearly Podcast, experienced LPs shared their most valuable lessons, drawn from years of investing across various asset classes and sponsor relationships.

Whether you’re just getting started or looking to refine your approach, here’s a list of their top takeaways.

1. Start with the Sponsor, Not the Deal

– Brian Davis, SparkRental (Investment Club)

A compelling pro forma doesn't mean much if the sponsor behind it lacks integrity or experience. Before analyzing returns or business plans, take a hard look at who’s running the deal.

“Evaluate the sponsor before you spend time evaluating the deal.”

This advice rings true across nearly every episode: strong sponsorship is the foundation of a strong investment.

2. Expand Your Deal Funnel

– Leyla Kunimoto, Accredited Investor Insights (LP Newsletter)

One of the fastest ways to improve as an LP is to review more deals. With greater exposure, patterns emerge, and your ability to assess quality sharpens.

“Whatever you do, increase the funnel of deals that you look at.”

Today’s platforms, and a growing network of collaborative LPs, make it far easier than ever before to review high-quality opportunities.

3. Define Your Investment Goals Early

– Leyla Kunimoto, Accredited Investor Insights (LP Newsletter)

Before sinking time into reviewing dozens of offering memorandums, ask yourself what you’re looking for in an investment. Do you want long-term equity growth or immediate cash flow? How much risk are you willing to take on? What makes a successful investment for you?

As you review deals and sponsors, continue to refine your investment criteria.

“Seeing a lot of deal flow makes you sharper as an LP in what you want. You want to be able to define what is in your ‘buy box.’”

Your “buy box” is your personal investment filter. Once you define it, you’ll know within minutes whether a deal is worth deeper diligence. Save time, save effort, and invest in deals that work for your portfolio.

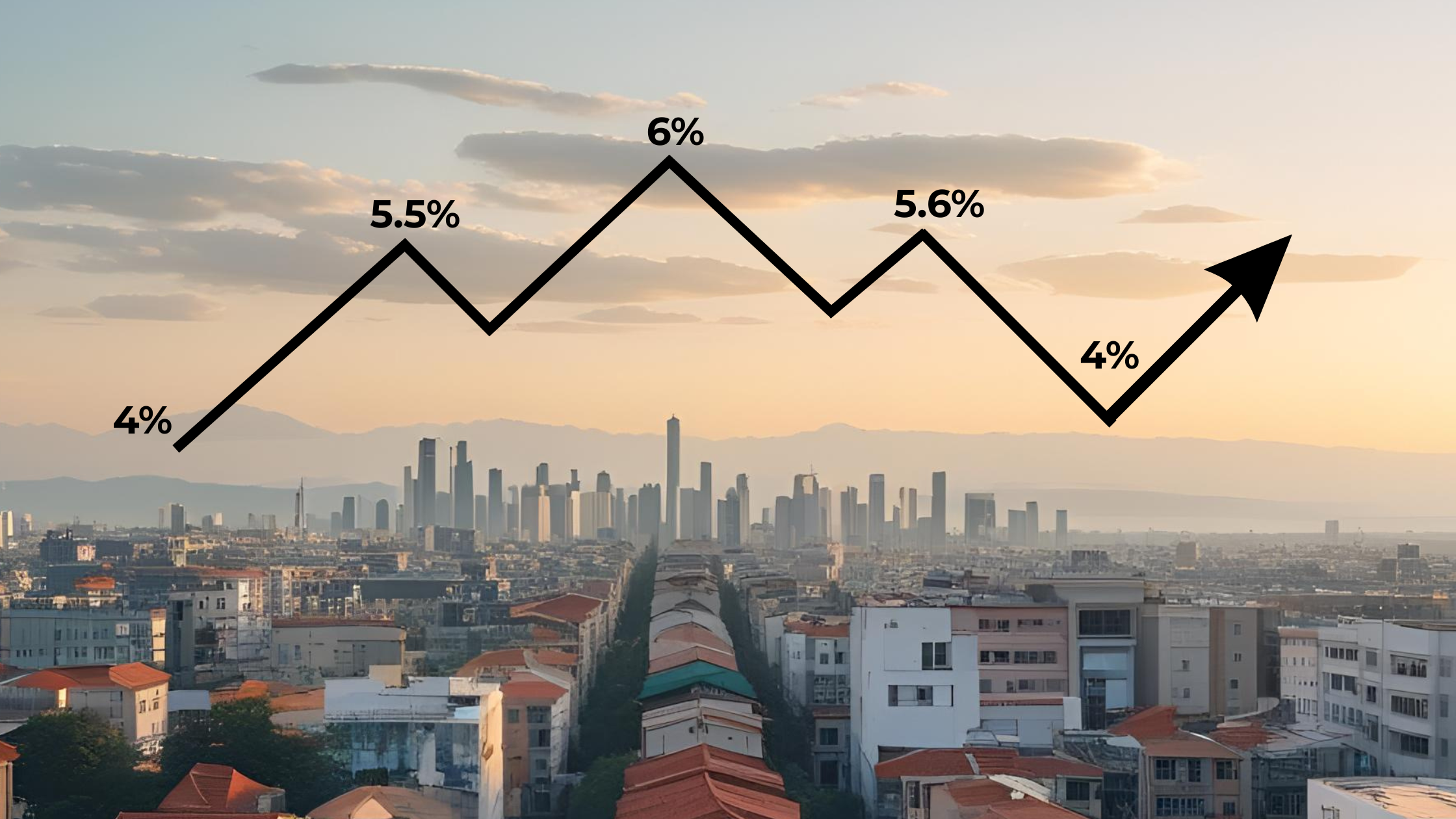

4. Focus on Cash-on-Cash Returns

– Leyla Kunimoto, Accredited Investor Insights (LP Newsletter)

Across multiple episodes of The Invest Clearly Podcast, guests continued to bring up Cash-on-Cash Return as a preferred metric. It’s particularly important for investors who prioritize passive income over long-term growth. It’s often left out of marketing materials, but LPs are getting smarter and diving into the ProForma.

According to Leyla Kunimoto, “Cash on Cash is one of the most important metrics.”

While IRR and equity multiples have their place, nothing reveals current yield like cash-on-cash.

5. Trust... But Always Verify

– Justin Colvin

When it comes to sponsor communication, do your homework. Take what they say seriously, but not as fact until you confirm it.

“Reagan said ‘trust, but verify.’ So just listen to what they have to say and take it, but go do your own due diligence.”

Even when sponsors offer to connect you with references, remember:

“Are they really going to give you the ones that have had deal failures? No, of course not... So you kind of have to do your own vetting outside of the sponsor.”

Invest Clearly provides Verified Investor Reviews so passive investors can easily access third party feedback. Reviews are used to find great sponsors, but also filter our poor performance.

6. Slow Down. There’s No Rush to Deploy Capital

– Justin Colvin

Many LPs feel pressure to invest early and often, but experienced voices say the opposite. Take the time to get it right. You might feel like there’s a great sense of urgency, but there are always more deals.

“Before you even invest... don't be so hot to jump in.”

In private real estate, capital preservation is just as important as return generation. There will always be another deal, but the wrong deal can wipe out your capital. Due diligence is your biggest protector against capital loss

7. Listen for Inconsistencies

– Terra Padgett, Power Pool Fund (Investment Club)

One of the simplest but most effective tools to vet sponsors? Repetition and looking for inconsistencies.

“Ask questions multiple times and listen for inconsistencies in how a real estate sponsor responds.”

If a sponsor shifts their story or seems evasive, consider it a red flag. LPs aren’t just passive capital, they’re partners. You deserve clarity and transparency.

Keep Learning: Passive Investing is a Skill

These insights collected from experienced LP guests of the Invest Clearly Podcast highlight one theme above all: LP investing is a skill, and it can be sharpened. By focusing on sponsor quality, reviewing more deals, defining your investment goals, and asking tough questions, you’ll put yourself in a much stronger position to succeed.

Found an interesting deal? Start your due diligence with Verified Investor Reviews on Invest Clearly.

Written by

Invest ClearlyInvest Clearly empowers you to make informed decisions by hosting unbiased reviews of passive investment sponsors from verified experienced investors.

Other Articles

LPs Have Been Slacking on Due Diligence—Here’s How to Step Up Your Game This Year.

Market volatility, rising interest rates, and unexpected shifts in asset performance have underscored the importance of thorough due diligence. For Limited Partners (LPs), the need to sharpen their evaluation strategies has never been greater. Whether assessing a new sponsor, evaluating a deal, or stress-testing an underwriting model, a refined due diligence approach can help mitigate risk and enhance returns.

What Is a Capital Stack?

Every real estate deal needs funding, which is why real estate syndication and private equity investments have become so widespread. However, where that money comes from and in what order it gets repaid isn't random. It's structured carefully, layer by layer, in what's known as the capital stack.

Power of Community in Passive Investing | Brian Davis

Brian Davis shares how Spark Rental's co-investing club vets deals, evaluates operators, and helps investors build passive income

What is a Capitalization Rate in Real Estate

Learn about cap rates, how they are used in commercial real estate, and how investors should consider them when evaluating passive real estate investments.

Evaluating Real Estate Sponsors: The Role of Social Proof in Investment Decisions

This article explores the role of social proof in evaluating real estate sponsors, the risks of relying solely on past returns, and the dangers of influencer marketing in investment decision-making.

What is a Syndication Real Estate Investment?

A real estate syndication is a common investment structure that pools capital from multiple investors to acquire and manage larger commercial real estate assets.